Power Purchase Agreements: What Types of PPAs Exist?

Power Purchase Agreements, or PPAs, are long-term power supply contracts. They serve as a hedge for operators of wind and solar power plants, as well as large power consumers, helping to reduce financial market price risks. Here, we present the key types of PPAs.

Definition: What is a PPA?

A Power Purchase Agreement, or PPA, is a long-term power supply contract, typically involving renewable energy. The parties to the contract are often power producers on one side and large consumers such as industrial businesses, data centers, or retailers on the other. Typically, the agreement includes both a specified quantity of power and a fixed price.

Why are PPAs so important nowadays?

PPAs primarily serve as a hedge for investors, acting as a tool for financial protection against market risks such as price and production volume fluctuations. In some cases, external financiers like banks or private equity firms make the conclusion of PPAs a condition for their involvement in renewable energy generation projects. Large consumers can also secure power at a relatively affordable price this way.

PowerMatch is FlexPower's first-of-a-kind PPA platform that enables renewable energy producers and storage operators to trade electricity directly with industrial and commercial electricity consumers.

Are Power Traders Being Bypassed Through PPAs?

PPAs between producers and consumers often occur without the involvement of power traders. However, in practice, these agreements are increasingly less likely to be made directly between the producer and the consumer, and are instead facilitated by power traders for both parties.

Although power traders charge fees for their services, this arrangement offers several advantages for both sides of the value chain. With their market expertise, power traders not only provide services like direct marketing and balancing group management - services that would otherwise need to be handled in-house - but they also frequently act as guarantors of hedging mechanisms. This makes PPAs considerably more flexible, allowing them to be tailored more precisely to the sometimes conflicting needs of producers and consumers. Through a process known as risk warehousing, power traders also manage price risks themselves. This is particularly evident when sellers and buyers prefer different contract durations.

What Criteria Differentiate PPAs?

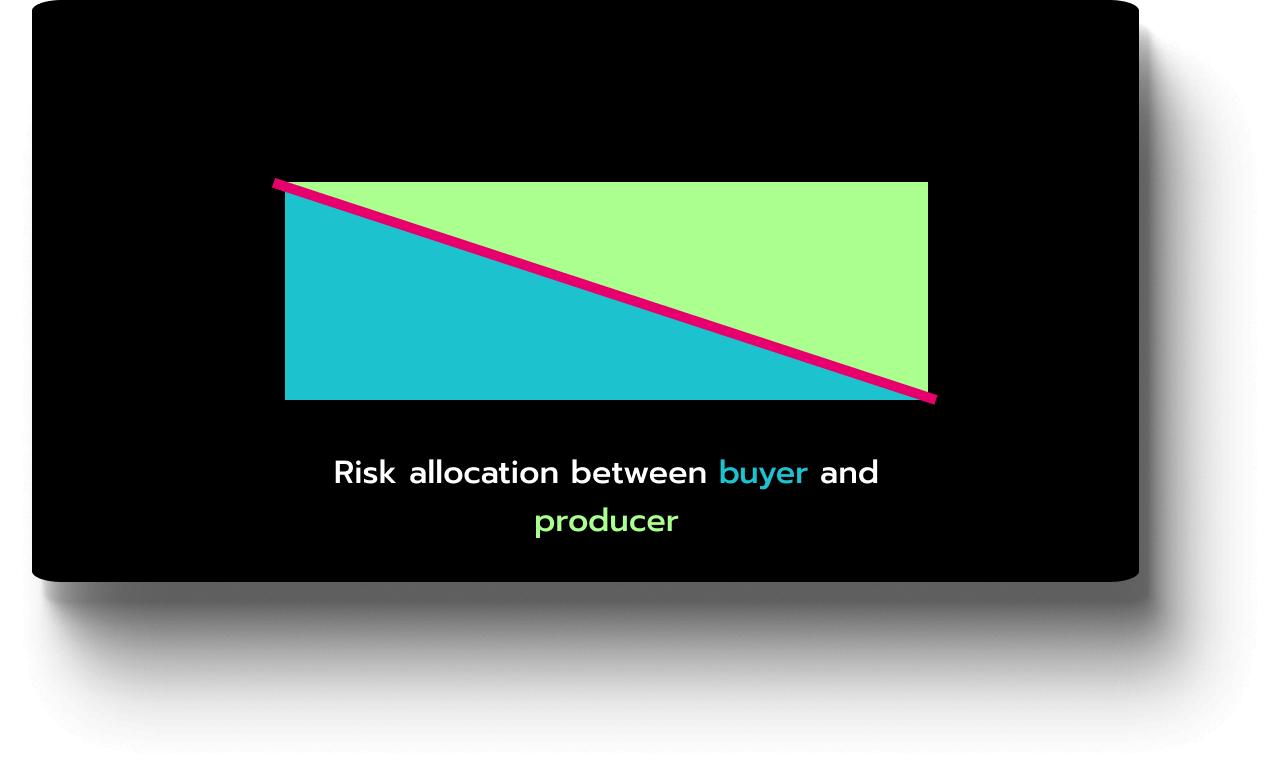

When referring to "types of PPAs," this generally concerns the redistribution of production risks or price risks. The "type" thus reflects only one facet of the complexity and variety of contractual arrangements. Power supply contracts differ in various ways, with multiple criteria often combined to create highly individualized contract structures.

Among the key criteria are the type of power generation, the method of delivery, the contractual partners, and the approach to reallocating price and production risks between the parties involved.

Flexibility Purchase Agreement (FPA) or Virtual Battery

A Flexibility Purchase Agreement (FPA) is, much like a PPA, a form of hedging in the power market. It involves bundling numerous decentralized generation, storage, and consumption systems in such a way that loads and generation can be strategically shifted within the power grid. This creates a simulated storage effect, which is why the term "virtual battery" has become widely used, especially outside of technical circles.

While the integration of physical power storage systems is beneficial, it is not a requirement. For example, a refrigeration unit could increase its cooling capacity at a given time (Time A) to virtually store power in the form of thermal energy (cold). At a later time (Time B), the refrigeration unit could reduce its cooling output, thereby allowing more power to remain in the grid. This is analogous to discharging a virtual battery. The calculated effect in the energy quantity accounts of the balancing group managers is identical to the charging and discharging of a physical battery.

For operators of pooled systems like heat pumps, blast furnaces, battery storage systems, or biogas plants, FPAs offer additional revenue opportunities. They receive compensation from operators of the virtual battery in exchange for their flexibility. This is why power traders prefer the more technical term, Flexibility Purchase Agreement.

PPAs by Delivery Type

Physical PPAs

Physical PPAs are those in which the delivery contract is fulfilled through the physical delivery of power.

Onsite PPA

An onsite delivery refers to situations where generation systems are directly connected to the consumption units of the buyer via their own power line. This could involve rooftop PV systems or wind turbines located near a production facility. It also includes so-called tenant power concepts, where property owners operate solar systems and sell the power to tenants.

This model is attractive because it avoids the need to use the public grid, potentially eliminating grid fees. However, the downside is that these generation systems do not participate in the efficient market trading on power exchanges, meaning their power is not available for general demand coverage. This could lead to economic distortions, as consumers might use tenant power simply because it is locally available, even if power is scarce in the grid - or vice versa.

Offsite PPA

Typically, the generation and consumption sites are geographically too distant to establish an exclusive power line. In such cases, the producer feeds power into the public grid, and the consumer draws it from the consumption site. The delivery then occurs on a balancing basis. The power is "physically balanced" from the producer's balancing group to the consumer's balancing group. Most PPAs fall into this category.

Synthetic or Virtual PPAs

Synthetic or virtual PPAs refer to agreements where the generation and consumption of power are not physically connected. The producer sells their power on the power exchange, where it is resold to other buyers. The consumer, in turn, purchases their power through the power exchange and the public grid.

However, within a virtual PPA, both parties agree on financial balancing mechanisms, whereby the market prices for power are settled against a "strike price" specified in the contract. The settlement is purely financial and does not involve the physical delivery of power.

PPAs Based on Contracting Parties

Originally, PPAs were primarily made directly between producers and consumers. These were typically distinguished between corporate PPAs, where a producer enters into an agreement with a large manufacturing or processing company, and PPAs where the consumer is a government entity or public body.

However, such straightforward structures are losing significance. As a result, the variety of PPAs based on the type of contracting parties has grown. Here is an overview.

Übersicht | Supplier | Balancing Group Management | Buyer |

|---|---|---|---|

Corporate PPA | Power Producer | Power Producer | Company |

Government PPA | Power Producer | Power Producer | Government entity |

Utility PPA | Power Producer | by arrangement | Utilities / Traders |

Merchant PPA | Power Producer | Traders / Direct marketers | Traders / Direct marketers |

Sleeved PPA | Power Producer | Traders / Direct marketers / Utilities | (big) End Consumers / Utilities |

Liquid PPA | Power Producer | Traders | Companies / Traders / Utilities / Consumers |

PPAs Based on Production Risk

When reallocating (transferable) production risks, the contracting parties have a significant amount of flexibility in how they structure the agreement. The key question is always who will bear the costs when the produced amount of power does not meet the required or agreed-upon quantity.

Which Production Risks Are Transferable?

Zunächst einmal liegt das Produktionsrisiko beim Erzeuger. Es besteht in der Unsicherheit, ob und wann er wie viel Strom produzieren kann. Teile davon lassen sich durch PPAs an Vertragspartner übertragen. Um diese wird es im Weiteren gehen.

Production Risks of Power Producers

No buyer will pay the operator of a generation facility for power that is not produced. The risk of underproduction - such as due to cloudy skies, calm winds, technical failures, or unscheduled maintenance - could theoretically be transferred through a PPA. However, in practice, this does not typically happen.

Through a PPA, producers primarily seek to establish contractually that they can sell at least the power they produce at predictable prices. There is, however, a long-term risk of overproduction: for example, who will purchase the 250 gigawatt-hours of annual production from a mid-sized wind farm?

In addition, there is the specific risk associated with the timing of production. The issue here is that the feeding profile of a wind or solar farm during the day will almost inevitably differ from the consumption profile of the buyer. The problem is that power must be drawn from the grid at the same moment it is fed in; otherwise, the grid frequency will go out of balance, potentially leading to a power outage. So the question becomes: who is responsible for ensuring that the power consumer always receives exactly the amount of electricity they need?

Production Risks of Power Consumers

A power consumer naturally only faces the risk of underproduction: If the supplier experiences a shortfall, the consumer must find alternative sources of power. This risk can be hedged through an appropriate PPA.

The risk of overproduction can only arise for the consumer through a PPA. This is especially the case with PPAs that require the consumer to accept the entire amount of production. Even a commitment to take a fixed quantity of power carries an overproduction risk, which arises if the consumer's own demand falls short of expectations. In such a case, the consumer must sell the excess power at market prices.

The same applies to the risk of production timing: It is unlikely that the power production will match the consumer’s exact demand. However, this risk arises from the PPA. With a traditional power supply contract at a fixed price, the consumer would hedge this risk 100% - but at a correspondingly high price.

Pay-as-Produced PPA

The consumer purchases all the power from a plant. If more power is needed, they must source it elsewhere. If less power is required, they must sell the excess themselves.

The production risk lies entirely with the consumer.

Pay-as-Nominated / Pay-as-Forecasted PPAs

The producer creates a schedule based on generation forecasts, usually one day before delivery. If the actual production deviates from the forecast, the producer must buy or sell the difference on the intraday market.

If the consumer requires a different amount of power than forecasted, they must manage their own balancing group, meaning they need to offset the discrepancies on the spot markets. If production deviates from the forecast, it is the producer's responsibility to smooth out the discrepancies.

The production risk primarily lies with the consumer, as the forecasts are generally very close to the actual generation.

Take-or-Pay PPA

The consumer agrees to pay for a specified amount of power, even if it is not taken. This means the consumer assumes the risk of either having to resell the unused power or, at a minimum, pay for it. In the latter case, the producer decides whether to produce the power and sell it elsewhere or curtail the plant.

The production risk lies entirely with the consumer. The producer may even have the opportunity for additional revenue if they can sell the already paid-for power to third parties.

Baseload PPA

The supplier guarantees a fixed supply of power for every hour (24/7/365) throughout the contract period, regardless of the actual production of their facility. Any deviations must be balanced every quarter-hour.

The production risk lies entirely with the supplier.

Firm (Volume) PPA

This operates similarly to a Baseload PPA, but instead of guaranteeing supply on an hourly basis, the delivery volume is fixed for a larger period - such as a day or a month.

The producer must ensure that they deliver, for example, 10 megawatt-hours (MWh) to the consumer over the course of a day. If less is produced, the producer must purchase the shortfall; if there is overproduction, it must be allocated elsewhere.

The exact timing of the supply is not specified. For instance, if the supplier delivers the entire 10 MWh in the morning, the consumer may need to resell part of it and purchase additional power in the afternoon.

The production risk is shared between the supplier and the consumer, with the exact division varying from contract to contract.

PPAs Based on Price Risk

When allocating price risk, the contracting parties have as much flexibility as with production risk. Four basic models are particularly influential:

Fixed Prices

The price is independent of the market, meaning neither party bears true price risk for the delivered power. However, the opportunity cost could be seen as an indirect price risk: If market prices are high, the supplier misses out on potential higher earnings, while the consumer loses out on the chance to buy at lower prices when market prices are low.

The (indirect) price risk is equally distributed between both parties. The exact distribution of the risk ultimately depends on the allocation of production risk.

Merchant PPA

In a Merchant PPA, the consumer pays the supplier the current market price. This modality is almost exclusively used between producers and traders or direct marketers, and the term "Merchant PPA" is sometimes used as a synonym for PPAs between producers and traders. Essentially, this is less of a true PPA and more of a direct marketing contract for generation facilities.

The price risk is shared equally between both parties.

Price Corridors

The price is initially based on a specific spot market price (such as day-ahead or intraday), with additional upper and lower price limits agreed upon. In this case, the supplier acts as the hedge provider when market prices exceed the upper limit, while the consumer is the hedge recipient. Conversely, if the price falls below the lower limit, the roles reverse.

Both parties share the price risk. The exact allocation depends on the chosen price corridor.

Contract for Difference

Contracts for Difference (CfDs) are a financial hedging tool used in synthetic PPAs. In this structure, power is traded on the power exchange, but afterward, the hedge recipient receives a compensation payment from the hedge provider.

In PPAs between producers and consumers or suppliers, the power producers are typically the hedge recipients. When power traders are involved, they often act as the hedge providers for both producers and consumers. The presence of a CfD doesn't necessarily indicate the distribution of price risk - it depends on the specific design of the CfD.

CfD with Fixed Price

In such a PPA, a fixed price is established as the underlying value. The consumer then compensates for the difference between the underlying price and the market price. If the market price is lower than the fixed price, the consumer reimburses the supplier the difference. If the market price is higher, the consumer invoices the supplier for the difference.

The price risk lies with the consumer.

CfD with Price Corridor

Instead of a fixed price, a price corridor is defined in this type of CfD, within which the supplier assumes the price risk. If the market price is below the corridor, the supplier receives a compensation payment. If the price exceeds the corridor, the supplier must reimburse the difference. This model is used in the EU to support wind and solar parks.

The price risk is shared between the consumer and the supplier.

A reversal of this principle is also possible, where the consumer pays a fixed price. This typically occurs when a trader acts as the hedge provider for both the producer and the consumer (Sleeved PPA).

In this case, the price risk lies with the trader.

Liquid or Tradable PPAs

Liquid PPAs, also known as tradable PPAs, are the counterpart to corporate, government, and utility PPAs. While bilateral PPAs can often involve complex contractual structures, liquid PPAs are standardized contracts that can be traded in full or in tranches on the exchange.

Typically, power traders or direct marketers are behind these contracts, offering producers the ability to sell power under simple, transparent terms. At the same time, they provide large consumers with renewable power on similarly straightforward terms.

Power traders usually don’t just act as intermediaries; they also handle balancing group management. They ensure that the generation and sales at the producer’s end and the purchase and consumption at the consumer’s end are matched on a quarter-hour basis. This means that traders assume the risk for both parties, should they need to pay for expensive balancing energy if their balancing group is not properly managed.

The greatest advantage for consumers is that their power deliveries are not dependent on a single facility, which could be disrupted due to production gaps, technical failures, or curtailment due to local grid congestion. In liquid PPAs, traders pool multiple power suppliers into a large virtual power plant, selling its production in liquid PPAs. Disruptions from individual producers are less significant and are factored into the pricing model.

Vergleich | Bilateral PPAs | Liquid PPAs |

|---|---|---|

Complexity | High (customised) | Low (mostly fixed prices for both sides, fixed quantities for buyers) |

Tradeability | Restricted | Easily tradable |

Target Group | Big Consumers with complex profiles | Small to large business customers, large consumers |

Default Risk | High due to "cluster risk" | Low due to risk spreading |

Financing | Requires detailed review | Simpler through standardisation |

Conclusion: PPAs – Distribution Mechanism for Renewable Energy

PPAs are contracts for the distribution of renewable energy, which allow investors in wind and solar power plants, as well as large consumers, to hedge against price and quantity fluctuations. Financiers often make PPAs a condition for loans or investments. The wide variety of PPA structures makes simple categorization difficult. Key distinguishing features include the type of power generation, delivery modalities, the sharing of risks between the contracting parties, and the nature of the contracting parties themselves.

While bilateral contracts with complex structures initially dominated, standardized, tradable products with risk diversification are gaining importance. This shift also means that PPAs are increasingly intermediated by power traders. They optimize contracts, handle balancing group management, and act as the hedge provider for this form of hedging.

From Action to Zuccess

Knowledge is Key

Achieving 100% Renewable Energy is a generational task which requires innovation and knowledge on an unprecedented level. We will get faster to 100% Renewable Energy when we as a generation share as much information as possible with each other. This is what we strive for with our School of Flex.

Flex Index

"How much money can I make with a battery?", we get asked a lot. To answer this question, we created the Flex Index, which is a transparent reference for the value of flexibility on the German power market. Check it out...

Videos & Podcasts

Nothing beats first-hand knowledge from experts. Our energy traders and engineers give insights into their job, the market environment they operate in, and what we are working on.

Speaker wanted?

You are on the hunt for a speaker on topics such as power trading, battery energy storage, or the need to balance renewables?

Ask for a speaker and we will send one of our experts to your lecture or conference.

Do you have it in you to be an energy trader?

Find out by taking the ultimate power trader's quiz and answer questions on energy markets and trading strategies!

Discover our Services

FLEXPOWER helps you to bring your portfolio to the energy market. We combine over 25 years of experience in renewables trading in our seasoned team of short-term energy traders. We manage large-scale renewable portfolios and flexible assets with our lean and fully digitized approach.